Very few people will walk into a car dealership, point to a vehicle, and say “Let’s sign a contract.” Most of us will compare the prices offered by a few area dealerships. When the salespeople know that they have competition, they begin reducing the initial price of the vehicle.

However, a lot of relocation management companies (RMCs) either own, or are owned by, mortgage companies. Therefore, when a client company wants to move its employees, the employees do not have a choice of lenders. The RMC and the mortgage lender know that the transferee is at their mercy with regard to price, scheduling, and customer service.

On the other hand, some RMCs use a multiple bid process in order to ensure that transferees are getting the best price and service. There are some significant benefits to going through an RMC and having their mortgage lenders compete for relocation business:

- It encourages the lenders to provide the lowest reasonable rates and closing costs

- Lenders provide very lenient underwriting guidelines to applicants coming from an RMC

- Access to discounted rates and programs only offered to RMC-referred borrowers

This is all accomplished by having at least three lenders provide bids for the transferee to create mortgage estimates based the transferee’s ability to repay the loan, the amount borrowed vs. the cost of the property, and the terms of the mortgage programs available, as a best practice.

Each lender understands that its objective is to win the business. Therefore, they try to provide mortgage estimates that are fair and accurate with relatively no cushion to the costs.

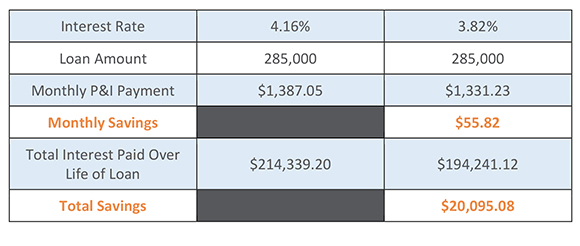

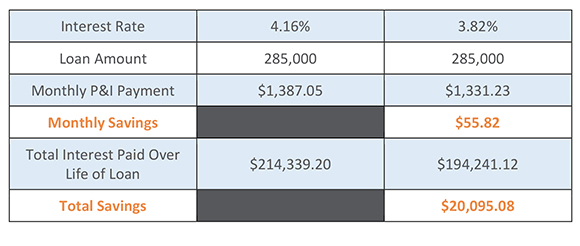

When utilizing multiple bids for mortgage services, transferees save an average of .32% on their mortgage rate. What does this mean for transferees? Based on information at the time of this article, the average 30-year fixed mortgage rate in the United States is 4.16%. Having lenders compete can get that rate down to 3.84%. Let’s see what happens with a $285,000 home loan:

The lower rate will allow transferees to explore more options like larger houses, better neighborhoods, or simply enjoying the monthly savings.

While cost is very important, so is the transferee’s experience. By allowing the transferee to meet with multiple mortgage lenders, he or she will feel more engaged in his or her relocation process. This promotes an overall good experience, because transferees tend to be happier if they feel that they are being heard throughout the relocation process. And we all know that happy employees are productive employees.

Global Mobility Solutions (GMC) is the pioneer of the “Freedom of Choice” model in relocation. By providing multiple bids for an array of providers, client companies and their transferees have saved money on services like household goods movement and, of course, mortgage loans. GMS continues to be an innovator of best practice workforce mobility programs in an effort to make relocations easy and practical for clients and their employees.

Learn more about the multiple bid process for mortgage loans, as well as other relocation services.

Need to include multiple bids in your relocation policy? Ask for a complimentary policy review.

Ann Knapp | CRP, GMS, CMC

Director, Transportation Services Ann has over 20 years of leadership experience in the moving and relocation industries. She is a council member for the International Association of Movers (IAM) Leadership Alliance. As a 2nd generation mover, Ann has worked in all areas of the industry from survey scheduling to claims settlement which has provided her with a well-rounded understanding of the ins & outs of moving. Ann is responsible for the day-to-day operations of the Transportation Team, the GMS Transportation Network, managing contracts, policy advisement, and monitoring quality.