Keep your Program Competitive with Home Sale Assistance Benefits

When a new or existing employee accepts a position in a different location and is willing to move, some of the main concerns they will have right off the bat are real estate concerns. Selling their current home, then buying a new house in the new city can cause anxiety. But if the company relocating the employee offers benefits with home sale assistance or real estate sale programs, it can make the relocation process much easier for both the employee and the company.

One of the most sought-after benefits to include in relocation packages is a home sale program. In basic terms, relocation home sale programs offer assistance to homeowners so that they can quickly move to their new city for the desired start date. While each relocation management company (RMC) will have different terms on their offered real estate programs, most usually include payments to cover real estate commissions and closing costs. Again, each home selling assistance program is different so it will depend on the seller’s/buyer’s situation on what can and cannot be covered or reimbursed. The type of program offered also depends on your company’s specific relocation policies and the level of support you offer to your relocating employees. Direct Reimbursement, Buyer Value Option (BVO), and Guaranteed Purchase Offer (GPO) are three of the most commonly offered relocation home sale programs. Here is a breakdown of each:

Direct Reimbursement

In most cases, this might be the simplest home sale assistance program for the company and the most involved for the employee. Under a typical direct reimbursement program, the employee is responsible for the sale and closing of their own home. This means they have to hire their own real estate agent and list the home (however many RMCs, like GMS, offer comprehensive home marketing assistance to help sell the property quickly and for top dollar). Once the property sale is complete, the employee then goes through the employer’s process of submitting expenses to be later reimbursed – generally these expenses cover the cost of the agent’s commission, closing costs, and the miscellaneous fees associated with selling a home.

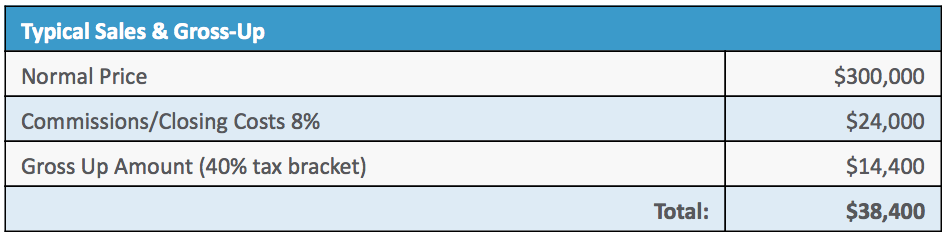

With direct reimbursement, the payment to the employee is viewed by the IRS as income and is subject to income tax. This can result in the employee receiving a reduced overall amount of support due to their unique tax situation. However, If the employer is offering the employee tax gross-up options, this could help offset the amount of tax dollars that the employee is having to pay, providing them with an elevated level of financial assistance.

Buyer Value Option (BVO)

Known as a 3-party transaction, the Buyer Value Option program can seem a little confusing to those who are not in the industry. Under a BVO home sale assistance program the employee lists their home for sale until a competitive outside offer is received. Then, the RMC will purchase the home from the employee based on a set sales contract amount. The RMC will then immediately sell the property to the outside buyer. Unlike the single transaction reimbursement program, this option has two transactions.

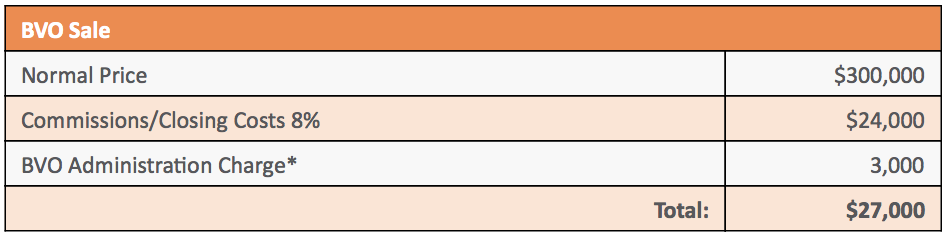

The main reason companies choose to offer BVOs in their relocation program has to do with the tax benefits, tax protection, and the reduced overall costs of this program. Under a Direct Reimbursement program (as described above), if the employee were to sell the home directly to the buyer, without the RMC middleman, then the IRS would view the reimbursement of expenses to the employee as taxable income. Companies help to offset this by grossing up the reimbursement, which drives up the total cost.

Under the advantageous BVO program, the home sale is tax-protected, occurs between the RMC/Company and the buyer, and no reimbursement or gross-up to the employee is required as the company pays the selling expenses. This reduces the tax liability for both the employee and their new company. The BVO home sale assistance program also helps cover the cost of the real estate broker’s commission and closing costs on the home sale. Lastly, the expense of an appraisal is mitigated, as the price of the home is driven by the offer received in the market.

Guaranteed Purchase Offer (GPO)

Sometimes called a Guaranteed Buyout (GBO), the GPO home selling assistance program is a popular one because it gives the moving employee a guaranteed home sale. Under this program, the employee lists the property for a set amount of days (typically 60-120 days) to try to sell on their own. If their home is not sold in the allotted time frame, the RMC/Company will then purchase the home from the employee, allowing them to move on to their ultimate destination without the stress of selling their property. The property then goes into the RMC/Company’s inventory and is now their responsibility to sell.

If the employee does get a qualified offer from a buyer within the specified timeframe, then the sale is completed similar to the BVO program (often called an Amended Value under these circumstances), where the RMC buys the home from the employee then sells it to the buyer for tax purposes. Again, making for two home sale transactions.

The major difference between the Guaranteed Purchase Offer program and the BVO is that in a GPO program, an appraisal is completed on the property to establish a fair market value of the property to establish the purchase offer price.

Choosing the Right Relocation Home Sale Program

Global Mobility Solutions has been helping relocating employees since 1987. Our team is always on hand to help your organization develop competitive and cost-effective home sale assistance programs. Reach out to us today with any questions regarding direct reimbursement programs, BVOs, or GPO. Our team is more than happy to help your company come up with the best relocation home sale programs possible to assist with meeting your talent acquisition objectives and improve the overall relocation experience for your transferees and their families.

Ready to Calculate YOur Program Savings? Request Access Now!

Are you ready to calculate your potential relocation program savings? Request access to our easy-to-use Relocation Cost Savings Calculator. Your Mobility Pro will grant your access request within 1 business day.