Employers and employees are grappling with the quandary of how to handle remote worker expenses. Simply put, there are many questions that remain outstanding relating to “who” is going to pay for “what.” With the world continuing to respond to the COVID-19 pandemic, the work from anywhere movement is further clouding some of these expense issues. As a result, understanding the issue is vitally important. Clear communication is critical to ensure the employer/employee relationship remains positive and supportive.

In some cases, the cost of telecommuting is simple to compute. An employee who lives within a few miles of a workplace might need to purchase some equipment to create a functional office in their home. While this sounds reasonable, there are other indirect expenses that may accompany creation of a home workspace. Often neither the employer nor the employee realize these indirect expenses until after they arise.

What are Remote Worker Expenses?

Compiling a list of remote worker expenses may sound like an easy task. And in reality, looking at the direct expenses is easy. These are the immediate out-of-pocket expenses involved in creating a workplace in the home.

Direct Expenses May Include:

- Voice Communication: cell phone or direct line

- Computer laptop, desktop, or tablet, with cords and monitors, mouses and mousepads

- Computer software and licenses including security setups

- Office supplies such as paper, pens, and folders

What about the indirect expenses? These are the expenses that accumulate behind the scenes, often relating to the direct expenses. However, they are often not recognized as remote worker expenses.

Indirect Expenses May Include:

- Electricity to run computer equipment

- Internet access and use

- Noise cancelling headphones

- Cell phone or direct line charges relating to increased work use

- Lighting for the home workspace

- Masks and safety equipment

- Heating and cooling of the home workspace during normal working hours

- Furniture used as office equipment on behalf of the employer

It is not always clear that companies have an obligation to pay for direct or indirect remote worker expenses. Some states require reimbursement for business expenses, while others do not. Employers should understand their obligations with respect to paying for remote worker expenses. However, they should also consider issues of fairness and equity for workers in these situations.

Work from Anywhere Policies may Impact Remote Worker Expenses

Beyond expenses relating to a home workspace, there are other considerations for remote worker expenses. Many companies now allow their employees to work from anywhere. As a result, some employees have moved from very expensive areas such as San Francisco, California to less expensive areas such as Missoula, Montana.

According to Salary.com, it costs 92.2% more to live in San Francisco than in Missoula. What is the issue for employers? Companies need to examine whether pay should be adjusted for remote workers who move from expensive cities to less expensive cities. Such worker pay adjustments would be subject to several complex issues. Pay varies by geography not just because of the cost of living, but by other factors including supply, demand, and productivity.

Thoughtful Consideration on Remote Worker Expenses is Important

It is easy to see how the issue of remote worker expenses may require employers to pursue some thoughtful consideration. While a few remote workers may save on costs relating to commuting or wardrobe, not all share the same level of savings. The cost burden of working from a home workspace is not always equal from one employee to the next. Fairness and equity should be top of mind for any company when looking at these issues.

It is also important for companies to examine their compensation policies. Changes may be in line for employees working from home workspaces, as well as for employees that move to lower-cost locations.

What Should Companies do?

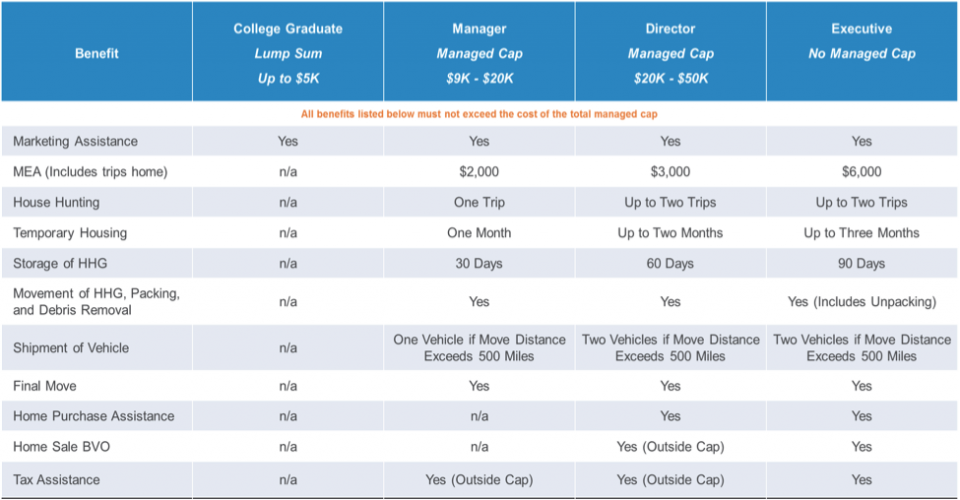

Companies should work with a Relocation Management Company (RMC) that has knowledge and experience in managing relocation and group moves. Qualified RMCs will help companies understand the issues and gain access to useful resources to guide policy decisions and follow industry best practices.

Companies should understand how to address issues relating to remote worker expenses. The transition from working in an office to working from a home workspace is similar to arranging for a corporate group move. There may be some expenses that the company chooses to reimburse. The GMS expense management program provides a quick and easy reimbursement process for employees, wherever they are located.

Conclusion

GMS’ team of corporate relocation experts has helped thousands of our clients with their relocation programs and group moves. As a result, our team can help your company understand the issues relating to remote worker expenses. We can also help your company consider the impact of work from anywhere policies on compensation issues.

GMS was the first relocation company to register as a “.com.” The company also created the first online interactive tools and calculators, and revolutionized the entire relocation industry. GMS continues to set the industry pace as the pioneer in innovation and technology solutions with its proprietary MyRelocation® technology platform.

New SafeRelo™ COVID-19 Knowledge Portal

GMS recently launched its new SafeRelo™ COVID-19 Knowledge Portal featuring a number of helpful resources including:

- Curated selection of news and articles specific to managing relocation programs and issues relating to COVID-19

- Comprehensive guide to national, international, and local online sources for current data

- Program/Policy Evaluation (PPE) Tool for instant relocation policy reviews

Contact our experts online to learn more about how your company might address the issue of remote worker expenses, or give us a call at 800.617.1904 or 480.922.0700 today.

GMS is sharing public knowledge and can help companies more clearly understand how to address remote worker expenses. However, GMS is not a CPA firm, and is not giving financial advice. Everyone’s financial situation is different; individuals and employers should consult their financial advisors prior to making any decisions.

We're Here to Help! Request a Courtesy Consultation

Are you ready to talk to a Mobility Pro? Learn how GMS can optimize your mobility program, enhance your policies to meet today’s unique challenges, receive an in-depth industry benchmark, or simply ask us a question. Your Mobility Pro will be in touch within 1 business day for a no-pressure, courtesy consultation.